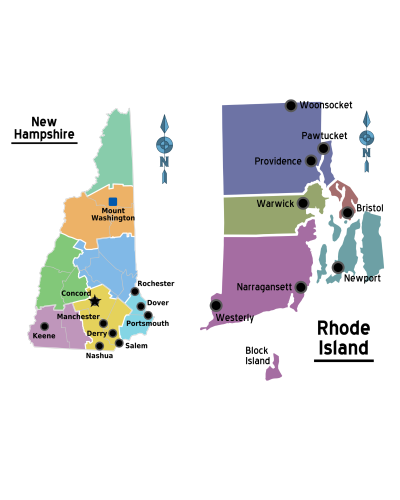

Being in Real Estate for almost two years has resulted in many questions. The most common being, “So how’s the market”. I always love to answer because, in today’s day and age, the market is always changing! In today’s blog, I wanted to talk about affordability. Which is something that I wish more people would talk about. Yes, you can see that housing prices are up, especially in the past 4 years due to all the major events that have happened. Additionally, I think that it’s important to mention, that this is coming from the perspective of a 23-year-old (me) who wants to buy a house. Instead of looking at the market and simply saying that houses are overpriced and, “I’ll never be able to buy” let’s talk about some of the things you can do to combat these prices. For simplicity purposes, I will be talking in vague terms, not about any region in particular. I grew up in Rhode Island and am pursuing a career in Real Estate. Having first started in my home state and am now transitioning to New Hampshire.

This is being written on Thursday the 8th of August 2024. Interest rates were just slightly dropped due to the unemployment rate increasing month over month. However, compared to a few years ago these rates are considered by many as high. Let’s start there, interest rates. Historically interest rates are not high. They are actually pretty average. Don’t forget in the early 1980’s the rates got over 15%! See the chart below:

How would you find a way to offset interest rates? Most companies offer a rate buy-down program. Typically for every 1% of the home loan, you can buy down 1% of the rate. For example if its a $350,000 home. If you get a rate of 7%, put 5 percent down ($17,500) your mortgage (without insurance and taxes) would be. The rate buy-down can last up to a year which could give time for rates to come down. With a 1% buy down (puts the rate to 6%) brings your payment down to $1,994 saving you $2,616 for the year.

Let’s talk about another way to combat these rates. It’s also important to set people’s situations. For this next example let’s focus on a first-time home buyer whether you are single or in a relationship. It’s as simple as purchasing a multi-family home or a property with income potential. Sometimes you can find multiple houses on a lot, which is perfect for passive income. For simplicity reasons let’s focus on a duplex. This property in particular will have a two-bed, one-bath in both units. Please remember that these numbers I am going to quote are national averages (USA). The average rental income for that type of unit is $1,750 a month. The average price of a duplex is roughly $575,000. Which (excluding insurance and taxes) brings your payment to $3,653 / month (30-year fixed, 7.052% rate). Now let’s do the simple math, with the other unit rented out, you are bringing your mortgage down to $1,903! The money you save by having a passive income source allows you to save your money and maybe even buy another investment property. If a property has a positive cash flow, its a no-brainer.

Let’s close this out with my goal for this article. Adjust your mindset. Do not tell yourself that you will never be able to afford a home. It’s the path to the American dream, the potential path to financial freedom, the path to the pursuit to happiness. Don’t get me wrong, home ownership is not all good things. It gives you a platform from which happiness is built upon. So, you can do this. You will achieve financial freedom!